Applying For A Personal Loan [Everthing You Need To Know]

Applying for a personal loan is reasonably simple, but there are some key things you need to consider before you take the plunge and do more damage than you think without thinking it through properly. Here is everything you need to know about applying for a personal loan before you take that step.

Can You Afford It?

The biggest mistake that people make is taking out a loan that they cannot afford to repay back to the lender. If you do this not only will you be in debt, stressed and unhappy, but you will also damage your reputation and credit rating, preventing you from getting loans in the future.

There are some key things you can do to ensure you can afford a personal loan. The first is to make a monthly budget, will the repayments including interest and any other fees fit into your budget. If not, it is time to re-consider your loan amount or finder a lender with fewer fees/lower interest rates. The second is to find out what your credit rating is and work to fix it if it is bad. Having a poor credit rating is not the end of the world, there are ways you can boost it back up again, but this often takes time, patience, and effort. It is best to avoid taking out a personal loan when your credit rating is poor as you will pay high-interest rates and put yourself at greater financial risk for the future if you miss a payment.

Opt for a loan that offers a longer repayment period if you want a lower monthly repayment, though these are often more expensive in total, they provide a solution that allows you to repay an amount you can actually afford.

Do You Have Pre-Approval?

Use a comparison tool to find and compare different lenders and their interest rates/additional fees. When doing this it is important to take note of the information they are requesting from you, this should not be a long application, it should be relatively simple and have no impact on your credit score.

Some of the information required for a “soft quote” includes;

- Name

- Address

- Income

- Social Security number

- Amount to borrow

- Reason for borrowing

They use this information to find out if you are eligible to start the official application process and it gives you a better idea of the interest rates you will be charged before you take the next step. No lender can guarantee you an approval or a special interest rate without you having gone through the official application process first.

You have received pre-approvals and offers online previously, but it is important to research all your options carefully before committing. Apply for 2-3 different lenders formally and then see what comes back.

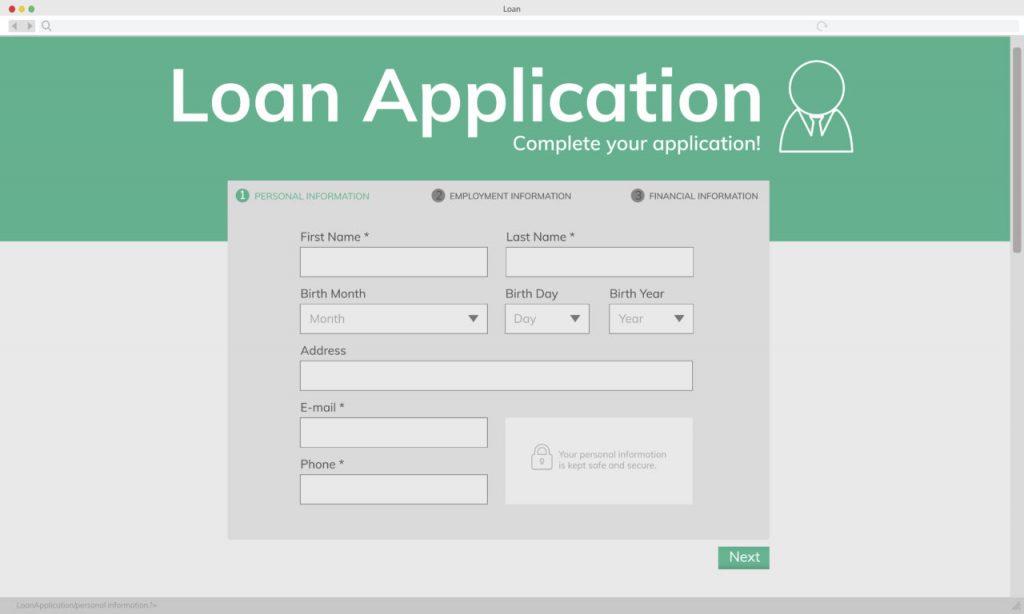

How To Apply:

- Fill in all the details on the official application form, most of the time a lender will have someone you can speak with to help you fill out this application.

- You will need your identification, social security number, income proof/long-term employment proof and often other documentation to confirm your identity.

- Generally speaking, they will look for a credit score of around 600 or above.

It should work for you:

You should never feel under pressure or stress when it comes to taking out a personal loan. Taking the time to do the research, read reviews and enter forums on different lenders means ensuring your personal loan works for you, not against you. Some key things to look for;

- They have repayment options that work for you – monthly, weekly, direct debit, manual payment etc.

- They offer extra features like 30 day return of the loan – no charges, fees etc.

- They have a good reputation for customer support and service.

- Their origination fees and other fees are reasonable (usually between 1-6%) and any penalties are also reasonable if you miss a payment.

- What are the payout early fees associated with the loan and what are the loan terms?

The Wrap Up:

To finalize, when applying for a personal loan there is more to consider than just entering your details and away you go. You need to be 100% sure that you want a personal loan and can afford it before going through the official application process. This will ensure your credit rating is not affected in the future and that you are financially prepared for what is to come.